A non-binding referendum on support for independence in areas controlled by the Kurdish Regional Government (KRG) left Iraq’s semi-autonomous region in the north facing a backlash from its neighbours and warnings of action.

Turkey and Iraq are strongly opposed to the formation of a new state on their borders and have insisted on Iraq’s territorial integrity.

While there have been no military attempts by Iraq, Iran and Turkey to force the KRG to back down, the three have already started implementing economic measures against the semi-autonomous region.

The Iraqi government suspended all flights to and from the KRG-controlled airports.

Tehran went a step further and closed its border with the KRG-controlled territory and banned Iranian companies from exporting crude oil from the region.

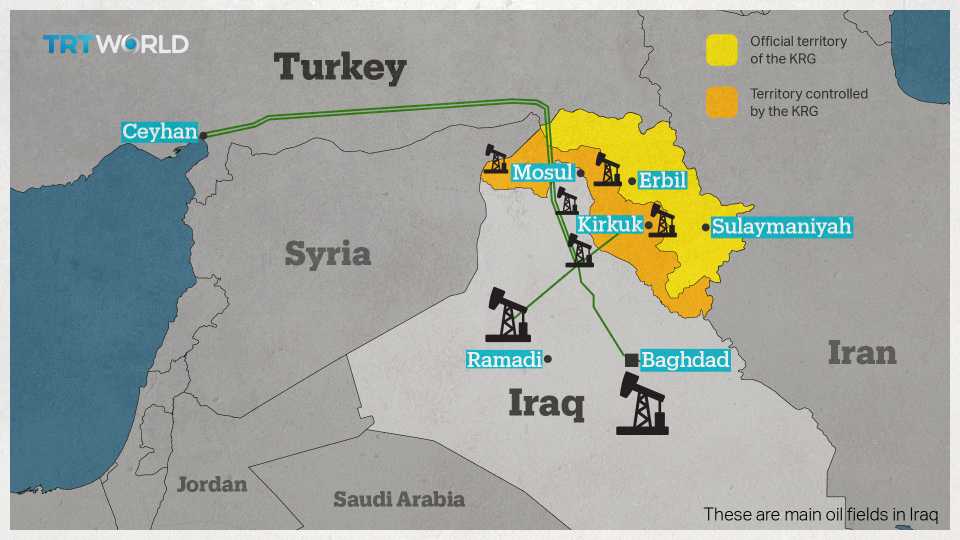

Turkey has so far kept its border open, but has imposed tight controls. The oil trade continues with exports from the territory leaving the country by a pipeline that runs from Kirkuk to Turkish port of Ceyhan.

Ankara has warned the KRG of other economic measures if it doesn’t pull back from the referendum, the results of which were overwhelmingly in favour of support for independence.

Meanwhile, Turkish President Recep Tayyip Erdogan is set to pay a rare visit to Tehran on Wednesday to meet his Iranian counterpart. Top of the agenda will be the referendum.

The two states say more economic measures could follow and Ankara went even further, saying it would shut the Habur border gate, its only gate with the KRG-controlled territory.

How will economic sanctions against the KRG affect the region and why is the Habur gate vital for Turkey and Iraq? Let’s break it down:

How would Turkey’s economic measures affect KRG?

Turkey is the KRG’s largest trading partner, responsible for more than half its construction business, which includes roads, tunnels, silos, dams, housing projects, and major airports in the territory. More than 1,400 Turkish construction companies operate in the KRG-controlled region.

But official data on Turkey’s trade with the KRG is not calculated separately from Iraq – which makes it difficult to know the exact value.

In 2013, Turkey’s exports to Iraq reached a peak of $11.9 billion, according to the Turkish Statistical Institute (TUIK). But due to the volatile security situation in Iraq, exports gradually declined to around $8 billion in 2016.

However, in the first half of 2017, exports ticked up sharply by 20 percent.

Last week, Turkey’s Economy Minister Nihat Zeybekci said that around $2.5 billion of all exports to Iraq were with northern Iraq.

The KRG is currently indebted to Turkish businesses to the tune of around $1.8 billion, while many Turkish nationals do business in northern Iraq, Zeybekci said.

“When you impose an embargo, your trade and exports stop. People may criticise me now saying ‘We talk about Mosul and Kirkuk as sacred causes but you are just talking about trade.’ But my job is trade. I am the economy minister and I have to reflect this side of the coin,” he added, underlining the importance of trade.

Iraq is the third-largest export market for Turkey in 2016, followed by Germany and the United Arab Emirates (UAE), according to the Association of Turkey-Iraq Businessmen and Industrialists (TISIAD).

How would Iran’s economic measures affect KRG?

Iran and the KRG have signed protocols to establish offices to boost trade by up to $200 million, which also includes building a crude oil pipeline from northern Iraq to Iran.

Bayram Sinkaya, a consultant to the Center for Middle Eastern Strategic Studies (ORSAM), said the annual trade volume between Iran and the KRG was at around $6 billion.

He said the pipeline project was still in the works, but the KRG’s independence referendum move would be an obstacle to improving relations between the two parties.

Iran is the second-biggest neighbour of the landlocked territories controlled by the KRG.

Why is Habur border gate significant?

The Habur border is the primary crossing for nearly all trading activities for the KRG-controlled region, making it vitally important in the dispute between Erbil and Ankara.

According to Association of Turkey-Iraq Industrialists and Businessmen (TISIAD) data, almost all exports in 2016 totaling $7.6 billion from Turkey to Iraq went through the Habur border gate.

These exports went mostly to the KRG-controlled region, according to independent sources – but did not include illegal trade passing through the border.

Speaking to TRT World, Nevaf Kilic, the President of TISIAD, said that the strain in relations hasn’t affected the trade at Habur border gate yet, but has affected business confidence on both sides.

“Habur border gate is the most busiest transactional gate in the world with 700,000 commercial trucks passing a year. More commercial vehicles carrying exports from Turkey pass through the Habur border gates to Iraq than all of Turkey’s other border posts combined,” said Kilic.

“Habur border gate is the lifeblood for the KRG, but it is also a very important gate for Turkey to go into the Iraqi market that we must not lose it to other countries in the region,” he said.

Businesses on the both sides of the border are worried – but Ankara is not expected to take punitive steps against the KRG with regards to the Habur gate.

When Turkey downed a Russian fighter jet, Moscow immediately cut almost all bilateral trade in response, and it cancelled visa-free commercial flights.

“During the crisis with Russia in 2015, the first thing they did was [restrict] trade. They tried to teach a lesson to Turkey through trade. This was very wrong. I wouldn’t find it right to repeat this mistake in the same way [against the KRG],” said Turkey’s Economy Minister Nihat Zeybekci.

How would Turkey’s possible measures on Kirkuk’s oil trade affect the KRG?

Although the oil-rich area of Kirkuk is a disputed area, according to the Iraqi constitution and is not officially KRG territory, the KRG also held the referendum in the Kirkuk region. It is under the control of Kurdish Peshmerga forces.

Kirkuk also exports significant oil reserves through a pipeline that passes through Turkey.

The central Iraqi government announced it would take control all of Kirkuk’s oil fields, in response to the independence referendum, including those in KRG-controlled areas.

Turkish President Recep Tayyip Erdogan also mentioned cutting off oil flows as a possible move, on the day of referendum.

“After this, let’s see through which channels the northern Iraqi regional government will send its oil, or where it will sell it,” he said in a speech. “We have the tap. The moment we close the tap, then it’s done.”

The KRG said it exported an average of 587,646 barrels of oil per day in November 2016, which represents about 12 percent of Iraq’s total supplies, as the oil pipeline between Kirkuk and Ceyhan in Turkey is still operating. Kirkuk oil makes up approximately one-third of the oil exported by the KRG via Kirkuk-Ceyhan pipeline.

According to the Iraqi constitution, the oil revenues from all around the country are to be divvied up, with the KRG entitled to 17 percent and central government 83 percent. But despite this, the KRG has signed bilateral deals with other countries or private companies and failed to give the 83 percent share of its revenues to Baghdad. This has been one of the biggest sources of tensions between Erbil and Baghdad in the past five years.

The Kirkuk-Ceyhan pipeline, a 986-km line established in 1973, carries oil produced in oil fields in Kirkuk and other parts of Iraq. The amount of oil carried from Kirkuk to Ceyhan rose to 70,9 million barrels per year with a second parallel pipeline established in 1987. The pipeline will operate until the end of 2025 under the terms of an agreement between Ankara and Baghdad.

The Kirkuk oil field was discovered in 1927 and is believed to have around 8.7 billion barrels in oil reserves, according to data provided by the central Iraqi government.

In order to survive as an autonomous region independent of Baghdad, the KRG is dependent economically on Turkey and Iran. Additionally, Turkey is currently the only outlet for its oil exports, which forms the major source of its income.

Discussion about this post